This week the news broke that the non-food online division of Tesco, Tesco Direct, will close in just a matter of weeks, putting 500 jobs at risk. The website that sold clothing, lifestyle items and homewares has been forced to cease business as it has “no route to profitability” – the reason given for this? Tesco said it was high delivery and marketing costs. My reason? Amazon.

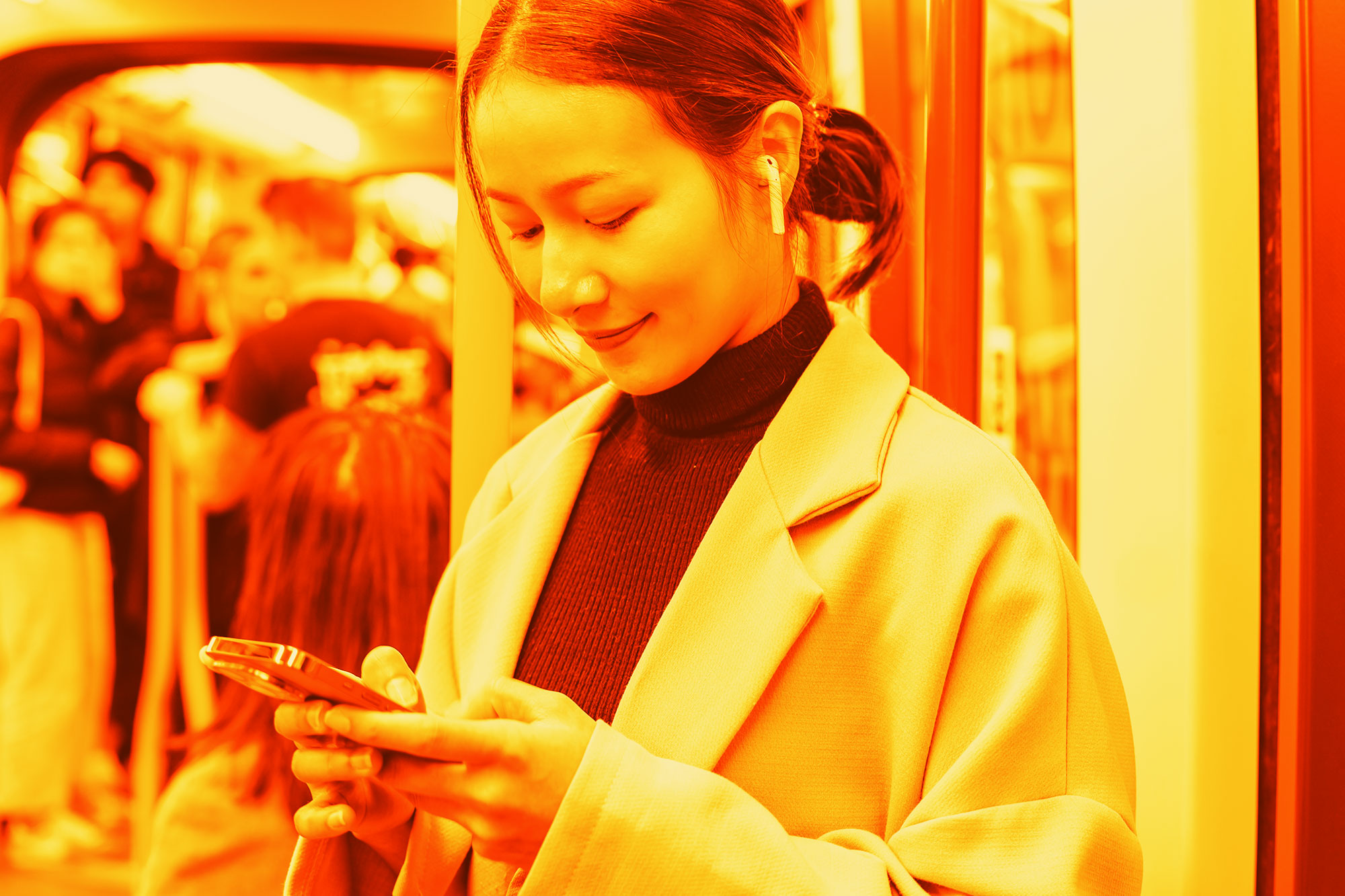

Amazon is ruthless, unwavering and we cannot seem to function without it! Need a new phone charger delivered by tomorrow? Amazon. Ran out of cat food? Amazon. Forgot to get your boyfriend a birthday present? Amazon.

Product searches needn’t begin on Google anymore; shoppers can turn to Amazon as the first port of call for even the most obscure of products – leaving other retailers on a backfoot from the very start. The ‘Amazon Effect’ is becoming a widely referred to phenomenon and for good reason. The giant is forever spreading its tentacles, venturing into, not just new categories of retail, but new sectors as it sets its sight on entertainment, shipping, food, healthcare and banking. A recent article by Natalie Berg in the Grocer put it well by saying, “It doesn’t just go after share of wallet. It goes after share of life.”

Combine this approach with competitive prices and Prime delivery offerings and it seems inevitable that websites, such as Tesco Direct, won’t be able to compete and are destined to struggle at best or at worst, collapse.

One of the key differentiators that is attributed to Amazon’s success is its relentless disruption which it continues to finetune. Recent years have seen the retailer lead the way with innovative shopping solutions such as its cashier-less shop Amazon Go and its AI-powered home assistant Amazon Echo. Each action is led by a vision that hasn’t changed since its inception: revolutionise in order to bring long-term value for customers.

The recent merger discussions between Asda and Sainsbury’s can also be attributed to the ‘Amazon Effect’. The supermarkets are attempting to take control of the market before Amazon, inevitably, does. Despite the infrastructure being in place, as it stands Amazon is not a food destination as it lacks a compelling range of products – something that an Asda-Sainsbury’s merger could certainly offer. With Sainsbury’s owning Argos, this merger would create a retailing powerhouse in food, clothing, toys, home and lifestyle.

Amazon’s continuous dissatisfaction with the status quo pushes all retailers, including supermarkets, to be on their toes and raise the bar in accordance with the standards the online retailer sets. We have already seen this in areas such as sophisticated delivery options and speed, voice technology and checkout options. Customers’ expectations are rising in accordance with the standards Amazon is setting, meaning retailers are having to keep on their toes if they are to survive.

Ultimately, nobody does Amazon like Amazon and neither Tesco closing its non-grocery website nor the Asda-Sainsbury’s merger will challenge the Amazon problem overnight, but both are certainly a step in the right direction to supermarkets surviving against the almighty Amazon.