Apple TV+ launched at the start of this month, entering the already-crowded arena of streaming platforms. With Britbox also having launched this month, and the likes of Disney+, HBO Max and NBCUniversal slated for upcoming release, the competition is set to heat up even more as the battle for subscribers continues. This new array of content also joins the established players like Netflix, Amazon Prime and Now TV, which account for usage in over 46% of homes in the UK.

Apple’s challenge is not only to stand out among the new platforms, with Disney emerging as its biggest rival, but also those existing channels which have cemented their places as the streaming giants and set the standards we expect from platforms today. Where ‘Netflix and chill’ has become a commonplace phrase, ‘Apple TV+ and chill’ doesn’t quite have the same ring to it. The reality is that even if we wanted to, most of us couldn’t afford subscribing to all the streaming services available, so the challenge for each platform is creating a higher value to the consumer than its competitors.

So, what is Apple’s strategy to break into the market?

Undoubtedly, Apple’s top priority is pushing its original content. Original content is on the rise across the board to combat the increasing threat of rights holders pulling their content from existing platforms to monetise it themselves – such as WarnerMedia pulling Friends from Netflix to include on its own upcoming platform HBO Max. By creating original content, Apple avoids this risk entirely. It has also invested heavily in talent, with its shows featuring huge names, from Jennifer Aniston and Steve Carrell, to Steven Spielberg and Oprah. This is a bid to assure consumers that its original content is going to be worth subscribing to. After all, you could say that Spielberg’s repertoire of blockbuster hits speaks for itself.

Apple has also opted for a staggered approach in releasing its content. Its launch debuted eight TV shows and one documentary film, and M. Night Shyamalan’s thriller ‘Servant’ is due to drop on November 28th. Although other dates are yet to be announced, Apple has an impressive amount of new content in the pipeline. Despite the pressure to churn out shows, a focus on quality over quantity could work in Apple’s favour. Meanwhile, Netflix has recently been flexing the ‘surprise drop’ strategy (staggered timings for new content) which Apple could end up imitating – although, it would likely need a healthy base of subscribers first to make this worthwhile.

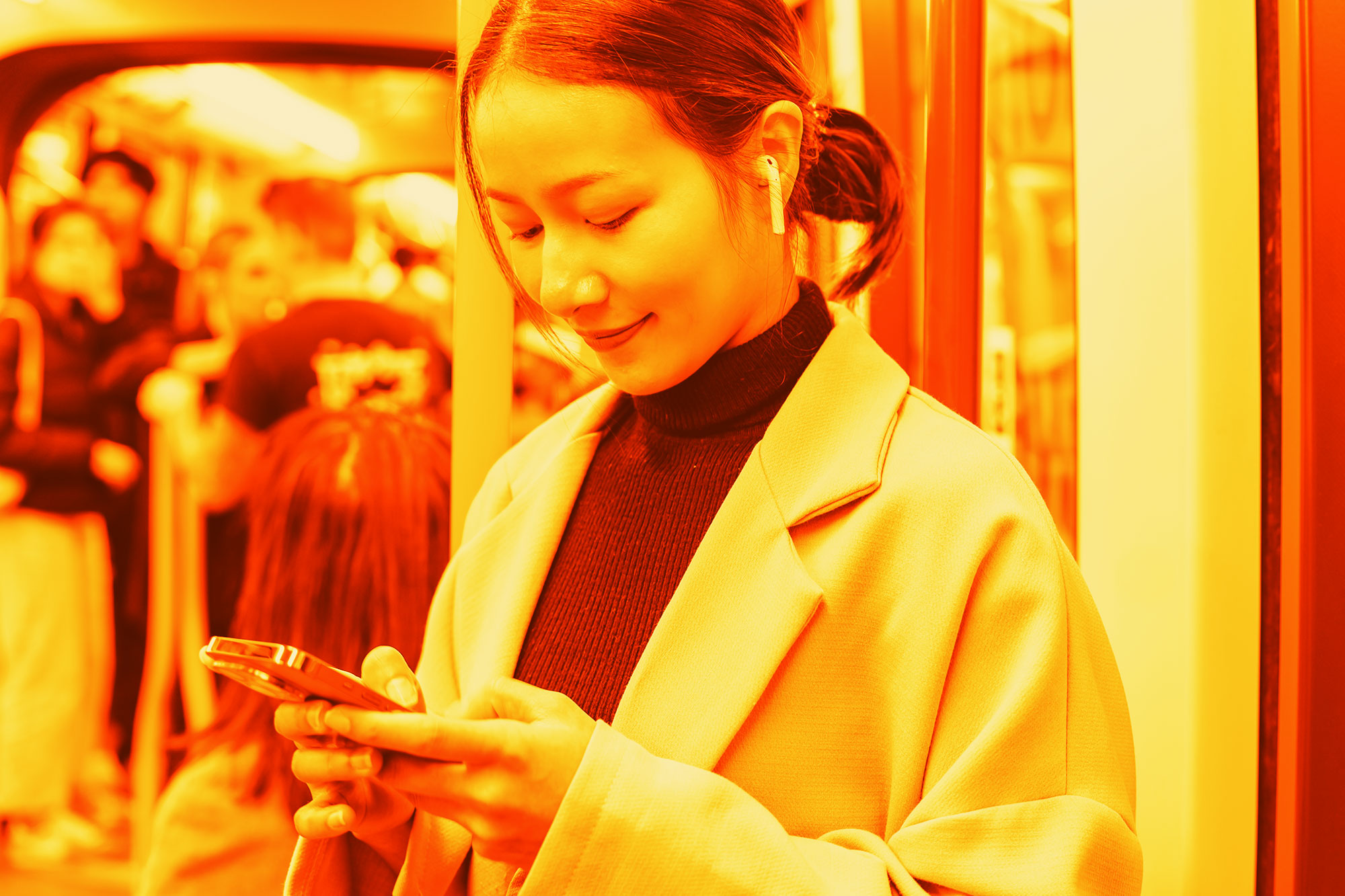

Another differentiator is Apple’s price. It’s cheaper than its counterparts at £4.99 a month, but arguably couldn’t justify charging more given its initial lack of content. It offers a one-year free trial for students, a clever strategy given that the student demographic is known for social media usage and can spread enthusiasm and positive reviews via social feeds and word of mouth. It’s also free for new iPhone and iPad owners. However, this offer was marred by technical difficulties on launch day as some users were unable to claim the free trial while others were given the offer without owning a new product.

Product accessibility is another issue. Apple TV+ is currently compatible with Apple devices, some Samsung smart TVs, Roku and Amazon’s Fire Stick, but not with any Sony, LG or Vizio devices. Additionally, although its price is lower than other streaming platforms, ‘stacking’ ends up being expensive (a term for subscribing to multiple platforms). In this sense, it will be harder for Apple to convince those already subscribed to existing services to unsubscribe and opt for TV+ instead. Its closest competitor, Disney+, has the advantage of existing films, rights to franchises like Marvel, and a global fan base. Meanwhile, HBO Max is an extension of its existing network, offering a combination of content already proven popular alongside new content that promises to be the same.

Ultimately, Apple TV+ needs to prove its original content is top quality, binge-worthy and appealing, as this remains its key differentiator in the increasingly crowded market. With good reviews it could see a surge in subscribers, but bad feedback could be its downfall. Whether I’ll subscribe? Only time will tell.